Malaysia - a fast growing access market

13 November 2023

Malaysia is a hotspot for access growth in the Southeast Asian market and in recent years has seen its number of mobile elevated work platforms (MEWPs) starting to rival that of Singapore - a close neighbour and long-established and mature access market.

Malaysia was certainly one of the countries represented well at the APEX Asia show, as representatives from the growing rental market there showed an interest in the products on display at the exhibition. (See the APEX Asia review in the soon to be pubished November-December 2023 issue of Access International).

In just a few years since the start of the pandemic in 2020, the number of mobile elevated work platforms (MEWPs) in the country has grown from an estimated 12,000 units to 20,000, with up 1,500 new scissors lifts expected to come into the market this year – not bad considering aging used equipment used to be the mainstay, as is the case with most emerging markets. The rise is even more impressive when compared to Singapore’s MEWP population of 25,000 – 30,000 units.

Fast developments

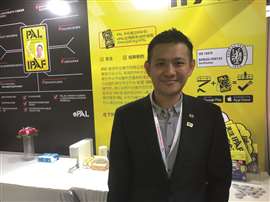

Edwin Siew Keab Seong, Director, BES Industry.

Edwin Siew Keab Seong, Director, BES Industry.

BES Industry is a Malaysia-based aerial specialist rental company with around 500 units in its fleet. The company started in July 2014, and as director of the company, Edwin Siew Keab Seong says, “at the time the industry was very young and there were not many rental companies. But it has developed fast since then and is now booming, particularly since the end of the pandemic.”

The growth is thanks to a range of companies moving to Malaysia, such as semi-conductor and solar specialists, joining others like Intel and Western Digital, due, in part, to incentives from the government.

“When I set up the business, 100% of machines were 10 years old or more,” says Siew Keab Seong. “While the rental rates for new and used equipment are not very different, used machines are prone to frequent breakdowns and it is difficult to find mechanics in the country that have knowledge of the equipment due to it being a young market. So when we buy new machines we ask the manufacturers to provide training and then slowly learn from instruction manuals and diagrams.”

Powering up

Alex Tan, owner, Aerial Global.

Alex Tan, owner, Aerial Global.

Alex Tan, a longstanding access expert in Malaysia, who now runs training and distribution company Aerial Global, says the industry is in catch up after the pandemic, with many companies wishing to avoid penalties associated with delaying projects beyond their intended deadline dates.

All these projects need power supply and Malaysia has an abundance of power thanks to the Bakun Damn in the Sarawak region of the country, which is another attraction for power-hungry buildings like data centres. The country has so much power that there are plans to build an underwater pipeline to Singapore to aid its power requirements.

This, combined with cheap vehicle fuel in the country thanks to further subsidies from the government, set alongside a now-stable political situation, all adds to the new growth potential. “Over the last five years there has been chaos in politics which is why mega projects and foreign investment have been put on hold,” says Tan.

Expanding on this, Seong says Malaysia is not yet ready for electric rough terrain (RT) equipment because of the low cost of diesel. “Fuel is still very cheap compared to other countries, so there are no advantages in 100% electric units.”

However, Seong adds, “The government will gradually bring down subsidies and electric products will become more popular. That’s why I have started now to meet that trend.”

A pair of Genie scissors belonging to BES Industry.

A pair of Genie scissors belonging to BES Industry.

According to Tan, Malaysia has a large acceptance of equipment made in China compared to other countries in the region with 70% of new MEWPs imported to the company this year having Chinese origin. In addition, rental companies from China are also showing an interest in Malaysia. For example, Shanghai Horizon – China’s largest rental company – has set up a pair of offices in the country to sell its used equipment, alongside a small rental entity aimed at Chinese construction companies working in Malaysia.

In addition, from 1 March this year the government has restricted the import of used machines, with stringent inspection rules in place before any equipment receives the required certificate of fitness.

“This has encouraged a lot of rental companies to buy more new machines,” says Tan.

Establishing rental

One of Aerial Global’s LGMG scissor lifts.

One of Aerial Global’s LGMG scissor lifts.

Indeed, there are now more than 50 rental companies in the country, many of them very small. The largest is TH Tong Heng Machinery which has nearly 2,000 units, says Seong, while Tan believes the second largest in the market, Schmetterling has just over 1,000 units.

They are followed by rental companies with 700 to 800 units. BES, which has around 500, is easily in the top 10.

Seong is aiming for 10-15% growth per year, however he says the overall market will expand around 20% per year.

One of the challenges in the markets, Tan says is that, “rental companies are still bringing in used machines that are shifting rental rates downwards. This is a challenge for rental companies trying to focus on new machines.”

A unique factor in the Malaysian access equipment market is its tradition of using truck mounts. Tan believes there are more than 60,000 in the market. Truck mounts were used in Malaysia long before scissor lifts and boom lifts were introduced in any meaningful way and are used in an array of applications.

Their applications are now starting to give way to self-propelled access. For example. truck mounts are losing out to boom lifts on long term rent.” More and more boom lifts are replacing the truck mounts,” he says.

STAY CONNECTED

Receive the information you need when you need it through our world-leading magazines, newsletters and daily briefings.

CONNECT WITH THE TEAM