Latest ERA/IRN RentalTracker survey: lower confidence, but no collapse

16 January 2024

More than 125 companies responded to the ERA/IRN RentalTracker survey for the final quarter of 2023. IRN’s Murray Pollok reports on the findings.

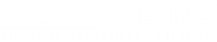

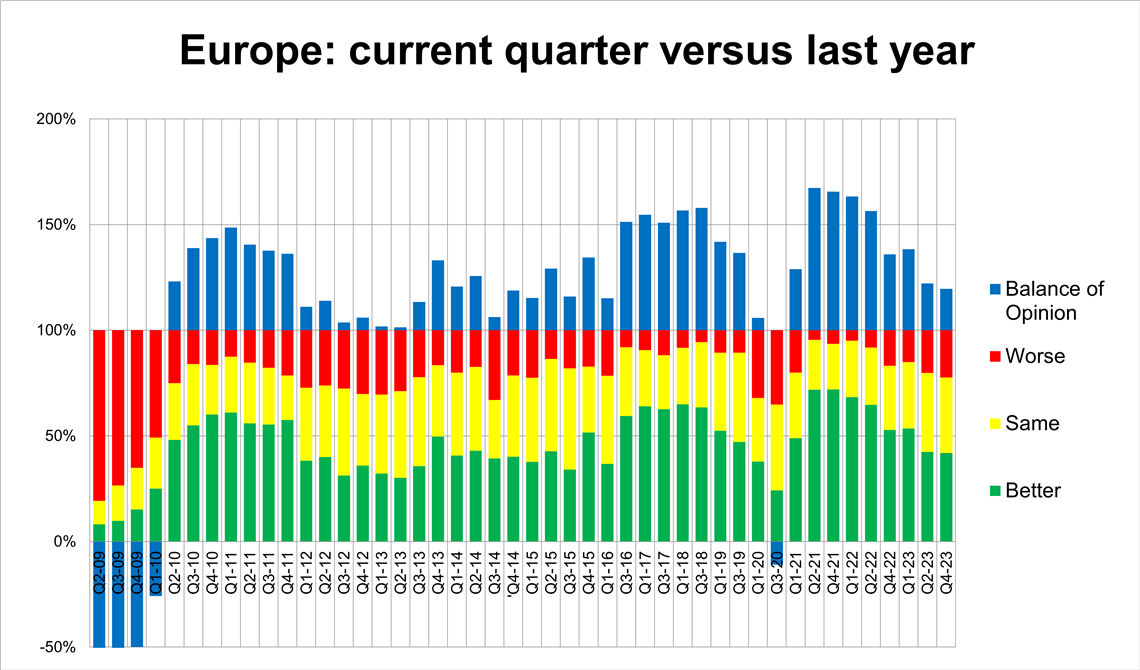

The noticeable deterioration in business sentiment in Europe’s equipment rental industry from the middle of 2023 continued through to the end of the year, although it is a far from dramatic decline.

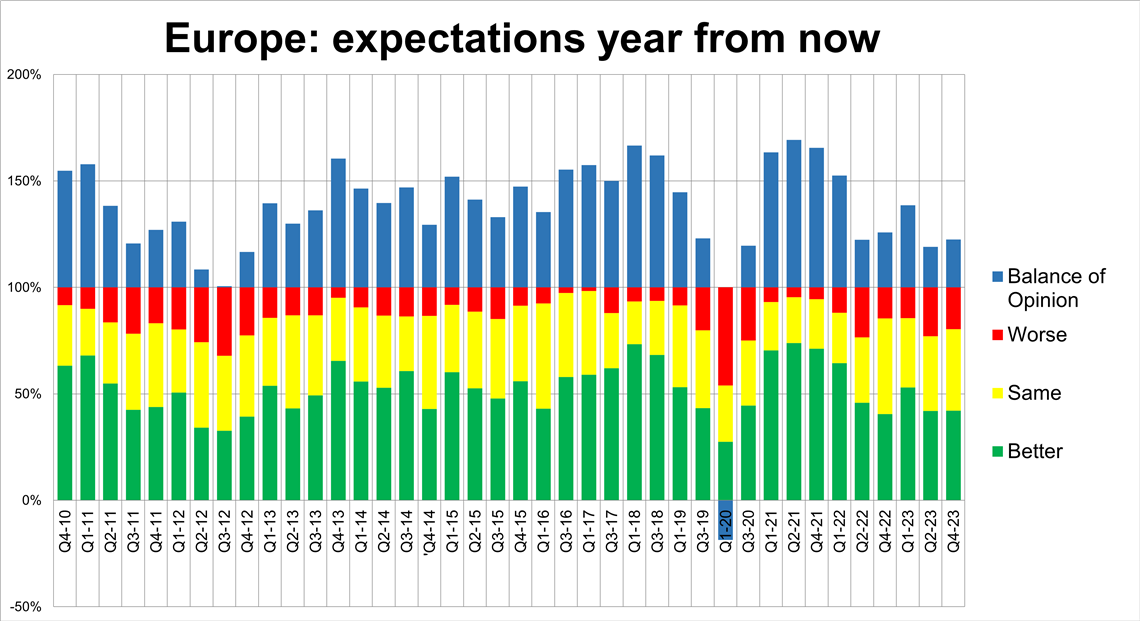

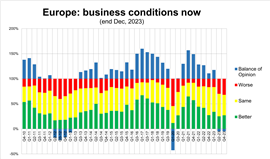

Rental confidence in Europe as measured at the end of 2023. (Image: IRN)

Rental confidence in Europe as measured at the end of 2023. (Image: IRN)

In the Q4 ERA/IRN RentalTracker survey, undertaken at the end of December and start of January, almost a third of companies reported a deteriorating situation, with more than 40% seeing no change and 27% reporting improving conditions. That led to a negative balance of opinion of -5% (the difference between the proportions reporting positive and negative views), which is almost identical to the results of the Q2 survey at the end of June 2023.

We have to go back to the start of the pandemic in 2020 to find another period of negative opinion on ‘current conditions’. This relatively low level of confidence should not be surprising, given that the survey took place at a time of higher interest rates and near or actual recession in the Eurozone and the UK.

However, the worsening conditions are not yet having a powerful impact on business volumes. There is still a large +20% positive balance of opinion on business levels in the final quarter of 2023 compared to the same period in 2022.

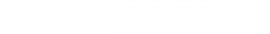

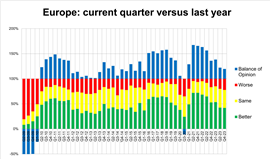

Rental activity in Q4 2023 compared to Q4 2022. (Image: IRN)

Rental activity in Q4 2023 compared to Q4 2022. (Image: IRN)

That means 42% were reporting an improved quarter compared to a year ago against the 22% reporting a worse quarter. Although still positive, that is lower than all the surveys since the end of the pandemic and shows a slowing up of year-on-year growth trend since the end of 2020.

That context, of a slowing up of growth rather than a dramatic reversal, is supported by the results of the ‘full year’ levels of activity for 2023 against 2022. Here, 57% reported higher levels of activity, with 26% reporting no big change, and just 17% reporting a decline in activity for the full year. That resulted in a pretty remarkable +40% balance of opinion on overall 2023 activity levels.

Key rental metrics

What about the key business metrics of utilisation, fleet capital investment, and employment intentions?

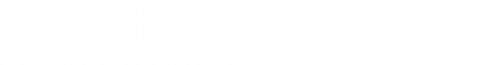

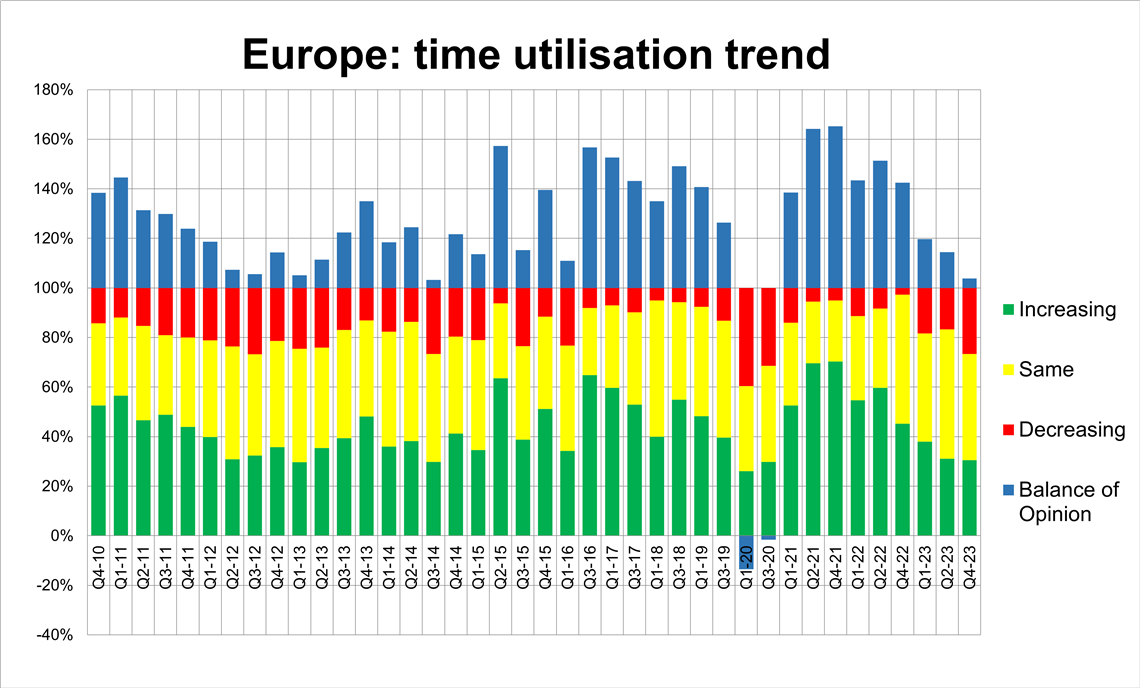

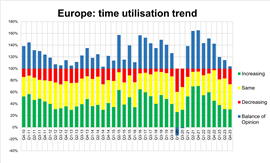

On utilisation the downward trend which started in the Q4 survey in 2022 continued, although there remains a very small positive balance opinion, just +4%. More than 30% of companies reported improving fleet utilisation against 27% who said it was worsening. Some 43% said it was steady.

That means almost three quarters of respondents says utilisation was either steady or increasing, so a positive finding given the wider economic conditions.

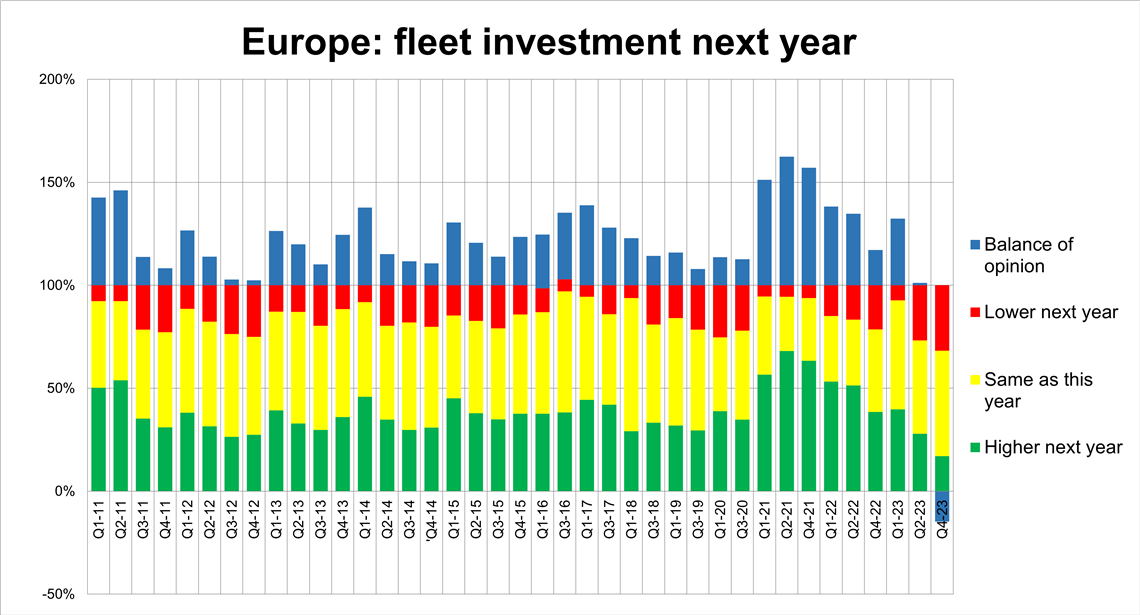

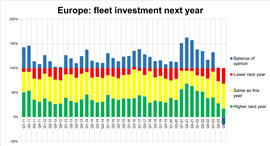

You might expect that rental companies would soften their fleet investment plans in the face of slow economic growth, and that is indeed what we find, and it is a significant shift, with a negative balance of opinion of -15% (equating to 17% expecting to increase spending and 32% expecting a decrease). More than 50% said investment would be the same as 2023.

Rental fleet utilisation trend at the end of 2023, from the ERA/IRN RentalTracker survey. (Image: IRN)

Rental fleet utilisation trend at the end of 2023, from the ERA/IRN RentalTracker survey. (Image: IRN)

Remarkably, that’s the first time in 10 years that there has been a negative balance of opinion on this ‘next year CapEx’ question. (For readers wondering about the pandemic period: when the crisis hit, companies were expecting higher levels of spending in the following year, when they anticipated that the crisis would be over.)

Demand for employees

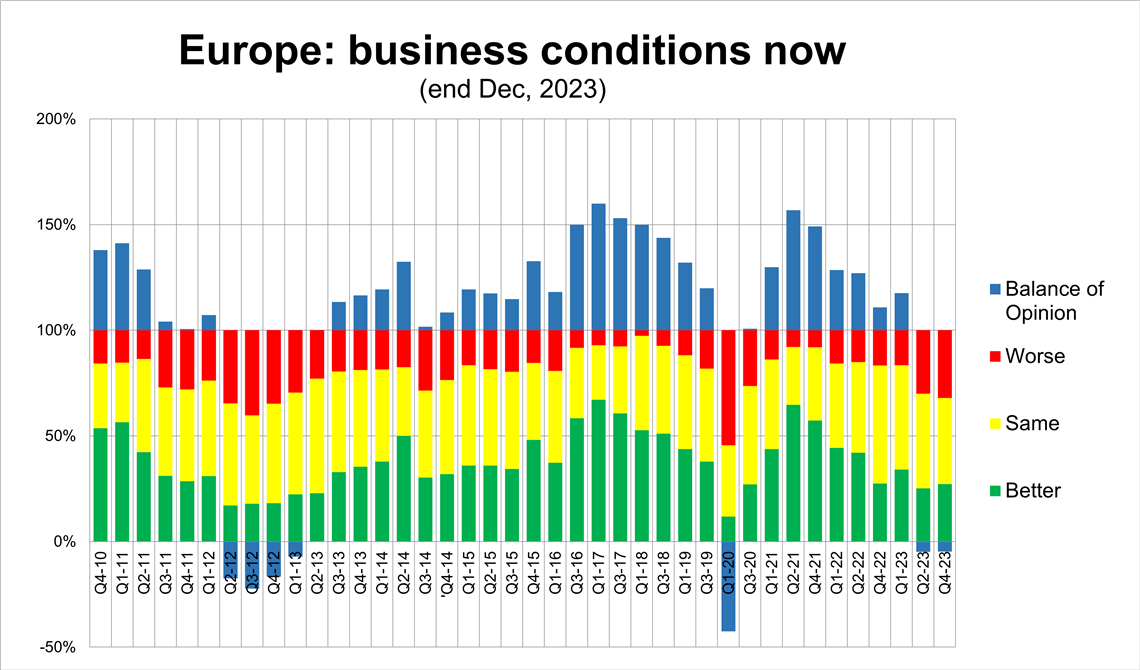

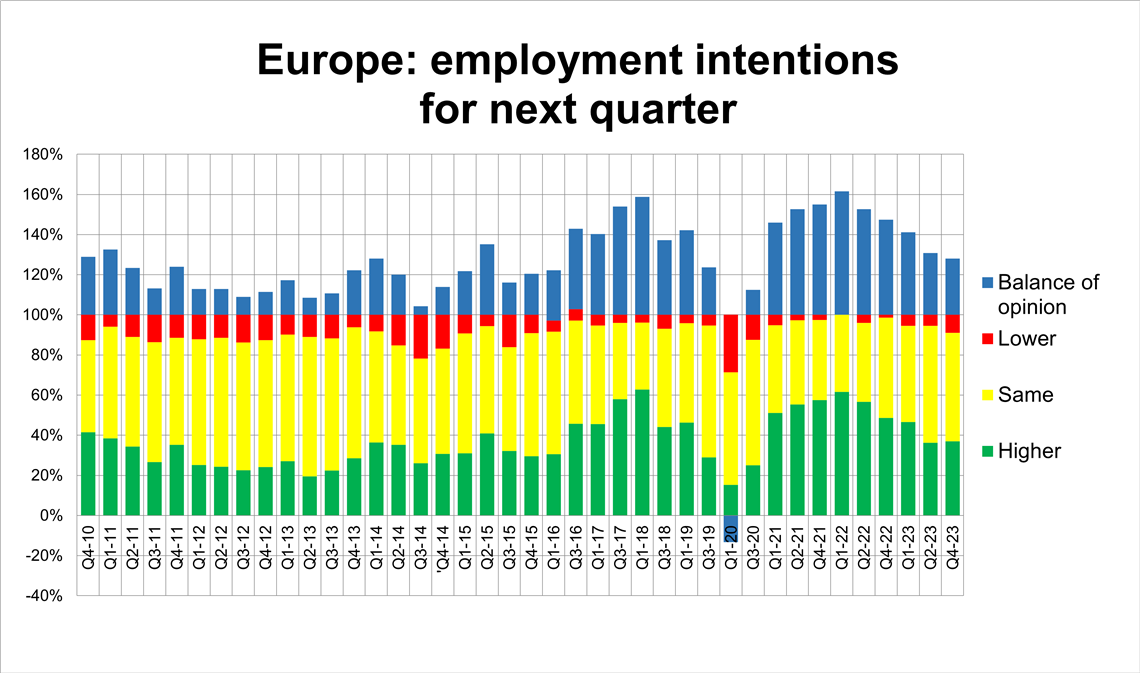

The employment question continues to be something of an exception to the broadly deteriorating trends, with many companies still trying hard to recruit staff. At the end of December, 92% of companies were either planning to maintain or increase their staffing levels and just 9% were expecting to reduce their workforces.

That meant a positive balance of opinion in favour of recruitment of +28%, which is high. Even here, though, there is evidence that sentiment is shifting down, with that figure being the lowest since the third quarter of 2020, during the pandemic. This positive balance has been steadily decreasing since hitting a high of more than +60% at the beginning or 2022.

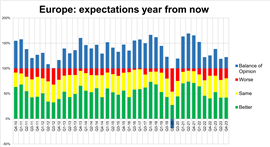

When asked about their expectations a year ahead, there was no worsening in sentiment compared to the previous survey in June 2023, and there was actually a small increase in the positive balance of opinion to +22.5% (it was +19% in Q2 2023).

That is still rather low, historically speaking, but remains a positive finding. It might reflect a generally upbeat view among rental companies about the potential for rental to grow as an industry, but is also likely a reflection of the shallow nature of the current recession (or near recession), which could imply a relatively quick recovery next year.

What changes to investment plans will rental companies make in 2024? (Image: IRN)

What changes to investment plans will rental companies make in 2024? (Image: IRN)

Countries and regions

This survey we had a particularly strong response from companies in Spain and Germany. In the case of Spain, there was a much greater degree of positivity than elsewhere: the country was top of the league in five measures: expectations for 12 months ahead, current market conditions, Q4 growth year-on-year, utilisation trends and employment intentions. In that sense it is an ‘outlier’ in this survey.

Germany was top of the league in terms of expectations a year from now – possibly reflecting the view that ‘things must get better’ – but bottom in terms of CapEx expectations in 2024 and one of the lowest in sentiment on current market conditions at the end of Q4 last year.

Multinational companies were generally more positive than their national or regional competitors, and were, for example, the most likely to be increasing fleet investment in 2024. That will no doubt please the OEMs.

The number of responses from countries like the UK, Italy and France do not justify definitive judgements, but in all three cases business sentiment was not high among those who did respond. In most of the metrics, the three countries were in the lower half of the league table. Notably, they were the least optimistic that things would be better 12 months ahead, in all cases fewer than 30% of respondents expected an improvement by January 2025.

How optimistic are European companies feeling about the future? (Image: IRN)

How optimistic are European companies feeling about the future? (Image: IRN)

So, the Q4 ERA/IRN RentalTracker manages to reflect quite well a particular moment in Europe’s rental market: slower general economic conditions, deteriorating conditions in rental at the end of last year, and a softening of fleet investment plans for this year, but simultaneously with activity levels holding up rather well.

We will see in the Q1 2024 survey at the end of March if they continue to hold up.

Notes:

- The full report, with more data, will be published in the Jan-Feb issue of International Rental News.

- The survey was conducted in the final week of December 2023 and first week of January 2024, with 125 companies in Europe taking part. IRN would like to thank the rental associations in Europe, including ERA, DLR, ASEAMAC and Assodimi, for their help in distributing the survey.

STAY CONNECTED

Receive the information you need when you need it through our world-leading magazines, newsletters and daily briefings.

CONNECT WITH THE TEAM